If you’ve already been through the home financing process once, you know how much effort and paperwork is involved. So what reason could there possible by to do it all over again? The truth is there are a variety of reasons for a redo. The process is pretty common, and its called a home loan refinance.

The two main types are known as cash out refinance loans and rate and term refinance loans. Cash out refinance loans, as the name implies, let homeowners use their equity in exchange for cash. Rate and term refinance loans let homeowners change their interest rate, the length of their loan, their loan type, or all three.

Tapping your equity

If the current market value of your home exceeds how much you owe on it, the difference is called equity. The amount of equity you may have could vary based on a number of factors and may fluctuate from time to time due to changes in the real estate market.

Through a cash out refinance, you may be able to use at least some of your equity as you see fit. Home improvement is one of the most common reasons to refinance, and there are specialized loan programs designed to help. Other common reasons include getting money for higher education or debt consolidation.

The LTV equation

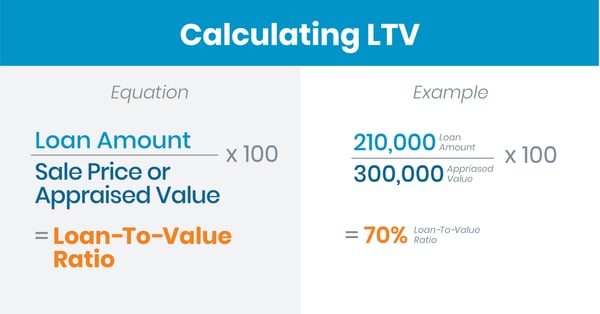

Be aware that you may not be able to access all your equity—or any of it—even if you owe less than your home is worth. Loan-to-value (LTV) ratio is a major consideration. For instance, some loan programs may only permit you to take cash out up to 80% LTV.

Let’s consider a simplified scenario: If your home is valued at $300,000 and you owe $210,000, you have $90,000 of equity and 70% LTV. If you pursue a loan that only allows you to take cash out up to 80% LTV, you may only be able to access the equity over and above 20% of the home’s value. In this case, that would be $30,000.

The good news is, there are loan programs that allow qualified borrowers to take cash out up to 100% LTV. A licensed Loan Officer can help you determine which program may best meet your particular needs.

Changing your interest rate

Generally, rate and term refinance loans are most popular when interest rates are dropping. Lower rates mean you’ll pay less in interest over time and may mean that you’ll be able to pay off your loan sooner.

However, there are some circumstances in which refinancing could be beneficial—and even result in cost savings—even if current interest rates aren’t significantly lower than your original rate.

If interest rates start to rise, or are projected to rise, homeowners with an adjustable rate mortgage (ARM) may wish to refinance and convert to a fixed rate loan, for example. This may help them avoid potentially substantial rate increases in the future.

Owners who have seen the value of their home increase might also consider refinancing, especially if they currently pay mortgage insurance. In many cases, if an increase in the home’s value pushes the loan-to-value (LTV) below 80%, mortgage insurance will not be required. Homeowners may also be able to refinance to a different loan type (i.e. from FHA to conventional) and possibly have access to more favorable rates and terms.

Rate and term refinance benefits

One common reason a homeowner may choose to refinance is to reduce their monthly mortgage payment, often by securing a lower interest rate. This may be achieved through a rate and term refinance.

To see if you could save by securing a lower interest rate, check out this nifty refinance calculator.

A rate and term refinance may also be used to reduce the term of a loan, by switching from a 30-year term to a 15-year, for instance. This could effectively result in the loan being paid off faster.

Reasons not to refinance

With all these benefits, are there any reasons not to refinance? That answer is also yes, and there are a few factors to consider.

The most important thing to keep in mind is that a refinance comes with some of the same closing costs you paid when you bought your home. If you aren’t planning on staying in your home for long, these costs might outweigh any benefits you could get with a lower rate. And if you can’t afford these upfront costs, a refinance may not be for you.

Second, some refinance types mean that your loan could take longer to pay off. This could mean paying more in the long run.

Conclusion

If you’re considering a refinance, you owe it to yourself to talk to a licensed Loan Officer. Our pros can help you uncover all your options and calculate your long-term benefits.

Contact your loan officer today for details and to request a customized quote.