If you’re new to home loans, you may feel like you’re drowning in a sea of jargon and acronyms. At Castle & Cooke Mortgage, we’re all about keeping your home loan experience super smooth and refreshingly uncomplicated. We’re here to demystify all those tricky terms before they trip you up.

Mortgage insurance is one of those terms that can cause confusion, but knowing just a few facts can help you make the best financial decision for your family and your future.

Mortgage insurance defined

Mortgage insurance can be a great way to get into a home if you have less than 20% to put down when you take out a home loan. But instead of protecting your home, mortgage insurance protects your lender in case you default on your loan.

Here’s how it works: if you have less than 20% to put down on a home, your lender may see you as a risky borrower. As a way to protect themselves and their investors while still making the loan, lenders require you to pay mortgage insurance.

This insurance comes in two varieties: private mortgage insurance (PMI) and mortgage insurance premiums (MIP). PMI is primarily for conventional loans, and you pay it every month as part of your mortgage payment. MIP is for FHA loans, and you pay a premium at closing in addition to monthly premiums with your mortgage payment.

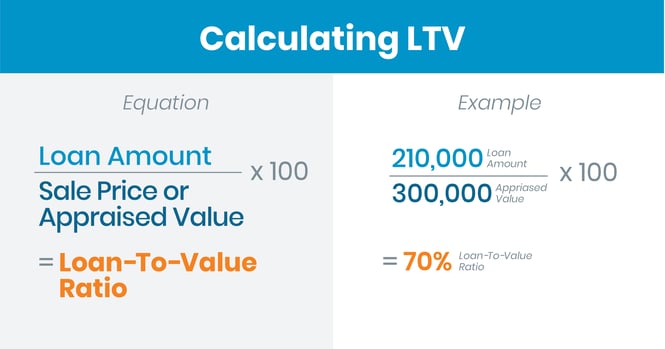

Another acronym gets thrown around a lot when mortgage insurance comes up, and that's LTV. It stands for loan-to-value ratio, and it refers to the portion of your home you own compared to how much your lender owns. If you had 20% to put down when you took out the loan, your LTV would have been 80%. That figure drops as the value of your home increases and you make payments toward the total amount borrowed.

How to drop mortgage insurance

Mortgage insurance costs differ depending on the type of loan you get, but average costs are between 0.5% and 1.5% of your total loan amount each year. For a $350,000 home, that would amount to between $1,750 and $5,250.

That’s a big chunk of change for a lot of families, but it doesn’t have to be a permanent cost of homeownership. Depending on your loan type, you can either drop it automatically or refinance into a new loan when your LTV is low enough.

Conventional loans

With this type of loan, it’s possible to simply request cancelation of your PMI once your LTV is less than 80%. If you don't make that request, the mortgage insurance will drop off automatically if your balance reaches 78% of the original value of the home or you reach the middle of your mortgage term—whichever comes first.

For that drop off to occur, you’ll need to be current on payments, have no additional liens, and your home can’t have decreased in value.

FHA loans

If your FHA loan started after June of 2013 and you had an LTV of 90% or more, you’ll need to pay mortgage insurance for the life of the loan. If your loan started before that time with that same 90% LTV, the mortgage insurance will automatically drop off after 11 years.

USDA loans

If you bought a home in a rural area using a USDA loan, you will need to pay mortgage insurance for the life of the loan. However, it may make sense to refinance when your LTV drops below 80%. Your loan officer can explain all the details.

VA loans

One of the benefits for current and former service members who utilize VA loans is that mortgage insurance is never required. However, you will be required to pay a funding fee when you first take out the loan.

Benefits of mortgage insurance

Some people avoid getting into homes of their own because they don’t want to pay mortgage insurance, but it’s important to understand that these payments can be a path to long-term wealth creation.

It’s all in the math.

If you have a $12,250 down payment and a loan worth $350,000, you’ll have an LTV of 96.5%, and you’ll definitely have to pay mortgage insurance. If that insurance costs 1% of the loan’s value each year, you’ll pay $3,500 on top of your regular mortgage payment.

Bummer, right? But wait!

As you make payments, your LTV will decrease and your home value is likely to increase - and could increase by quite a bit. From November 2020 to November 2023, median home prices for existing homes have increased by over 4% nationally, according to statistics on Bankrate.

Keeping things conservative, let’s imagine your new home's value increases by 5% every year for the next five years. By then, your home would be worth nearly $450,000! Meanwhile, your payments would decrease your principal. You stand to have as much as $100,000 in equity, even if you pay a total $17,500 in mortgage insurance.

That's an increase in your net worth of $82,500! And if the market stays this hot, you stand to gain even more.

Talk with a Loan Officer today

To find out more about how your options could open up by being willing to pay mortgage insurance, we encourage you to get in touch with one of our friendly Loan Officers. They can look at your savings for a down payment, tell you about down payment assistance available in your area, and help you understand all the potential costs and benefits.

The benefits of homeownership await!

Source: https://www.bankrate.com/real-estate/existing-home-sales/